ArcelorMittal has recently raised its Hot Rolled Steel Coil prices, other mills are not active in the market, and the market generally believes that prices will rise further. At present, ArcelorMittal quotes the local hot coil price for June shipment at 880 euros/ton EXW Ruhr, which is 20-30 euros higher than the previous quotation. At present, the market transactions are light, and traders will not buy in large quantities due to sufficient inventory and concerns about subsequent price uncertainty. However, the plate orders for the May-July shipping schedule have been fully booked by European steel mills.

At present, the supply of steel mills at home and abroad is tight, and the order volume is sufficient. The restart of equipment from February to March has not yet restored the previous production rate. In order to replenish the inventory, buyers only accept the transaction price of small tonnage. The price is also supported by the transaction mode of small tonnage, but as the traditional off-season, and under the premise of following the market cycle, the price is expected to show a downward trend in May and June.

On March 15, the price of hot coil in the European domestic market was 860 Euro/ton EXW Ruhr, with an average daily increase of 2.5 Euro/ton, and the feasible price was around 850 Euro/ton EXW. The price of Italian Steel Coil was 820 Euro/ton EXW, which was feasible The price is 810 euros/ton EXW, and it is expected to rise to 860-870 euros/ton EXW in the future.

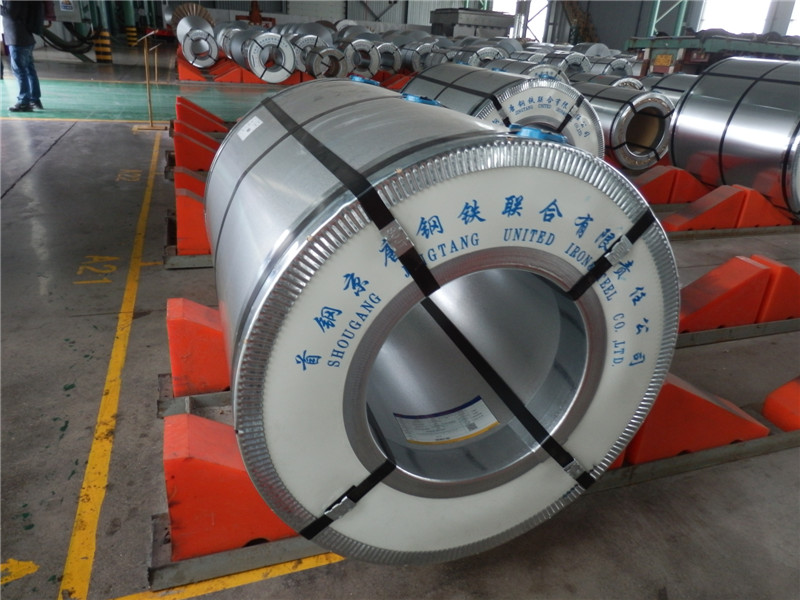

In the import market, the supply is limited, and Asian resources will basically be delivered during the period from the end of July to August, and the quotation of raw materials is 800 Euros/ton CFR Antwerp. On March 15, the CIF price of Hot Dipped Galvanized Steel Coil in southern Europe rose by 10 euros per ton to 770 euros per ton. Raw material from Asia was quoted at €770-800 per metric ton, while material from Egypt was quoted at €820/t cif Italy.

Post time: Mar-17-2023